Delaware Casino Tax

Tax Rate Dropped for Delaware Casinos. The bill guarantees that the tax bill for the casinos will be reduced. Taxes on slot machines will be dropped by one percent, from the current 43%. However, table games will not be taxed at 15%, a drop from the current 30%. DOVER, Del.- Delaware casinos could soon get a break.Delaware officials are considering cutting taxes on the state's three casinos, allowing them to keep more of their profits. The Delaware Division of Revenue's mission is to collect 100% of the taxes and other revenues required by law to be remitted to the State of Delaware, no more and no less, and strive to do so in a manner that creates the highest possible level of satisfaction on the part of our customers. Delaware Tax Relief Could Stall Skepticism from Delaware House Speaker Pete Schwartzkopf (l.) over a bill to give the state’s three casinos tax relief could lead to yet another defeat in the state legislature. Delaware casinos are suffering after competition was added in Pennsylvania and Maryland. The typical Delaware homeowner pays just $1212 every year in these taxes. Delaware Tax on Cigarettes. The state of Delaware increased the tax on cigarettes by $0.45 in 2009. Other products made with tobacco also had their rate increased. Cigars and tobacco, for example, increased the tax rate by 50 percent of the purchase price. Delaware Tax on.

What do you want to know?

Here are the most frequently asked questions about the Lottery, and the answers. If you have a question that we haven't answered, you can Contact Us. You can also get more familiar with some commonly used Lottery terms.

Winning/claiming your prize

In addition to checking your Winning Numbers here, in the newspaper or by calling the Player Information Line, you must take your ticket to any Lottery Retailer or to the Delaware Lottery Office for verification. You must claim winning drawing tickets within a year of the drawing date, and Instant Game tickets within a year of the announced end date of the game.

Official drawing results used in the validation and payment of winning tickets are recorded in the drawing records of the Delaware Lottery as certified by an independent auditing firm. In the case of a discrepancy between the published information and the official drawing results, the official drawing results shall prevail.

Yes, Delaware State law allows all Delaware Lottery winners to remain anonymous.

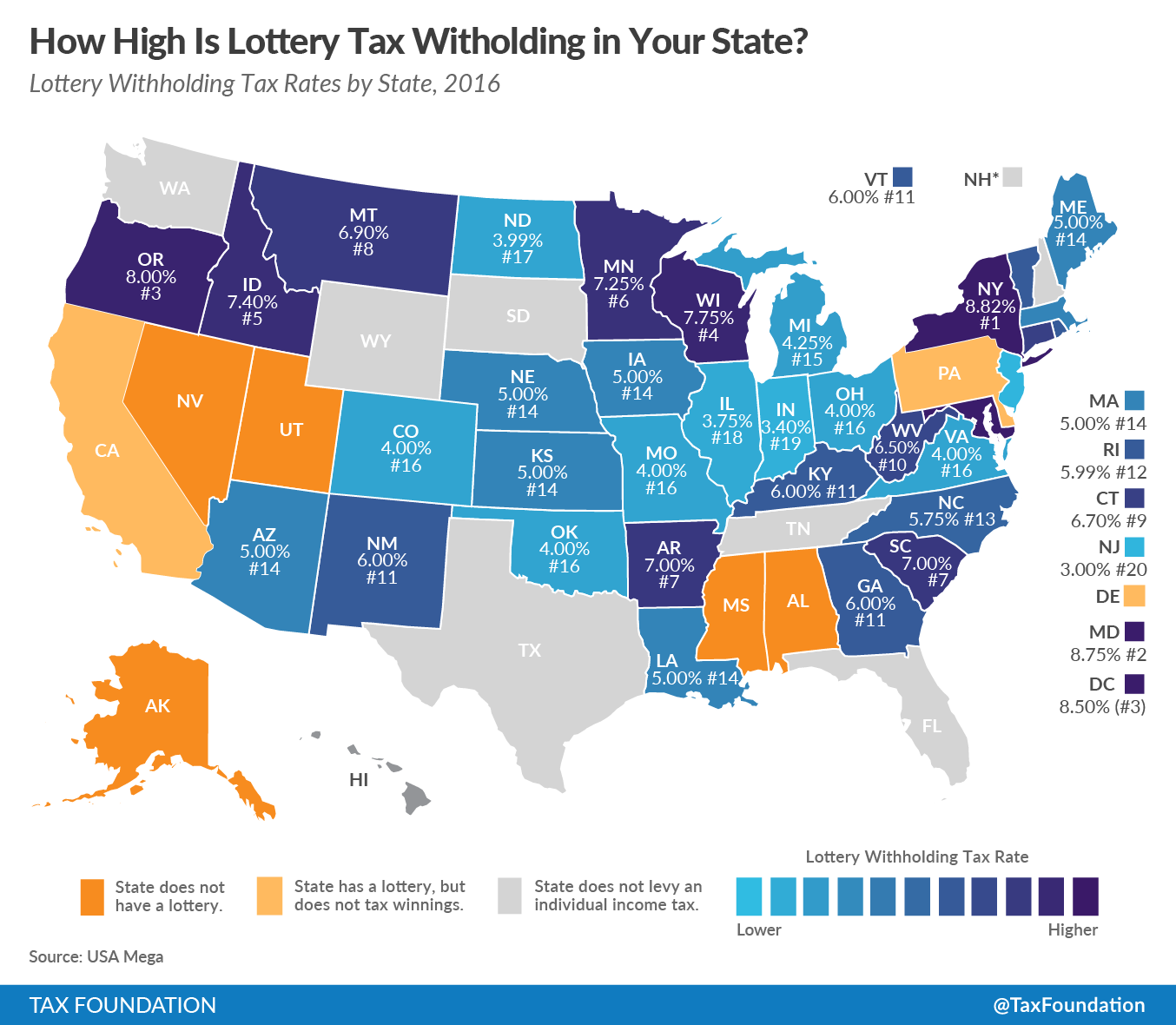

For any prize of more than $5,000, the Lottery withholds 24% of your winnings for Federal tax. All winning Delaware Lottery tickets are subject to Delaware Income Tax. However, if you are not a Delaware resident, your state may tax your winnings. For Sports Lottery - any Sports Lottery prize that is over $600 and more than 300 times the wager requires the Lottery to withhold 24% federal taxes. The winning may also be subject to state or local taxes.

For Powerball, Mega Millions and Lotto America, players may select the cash or annuity option for jackpot wins at the time the prize is claimed. The option for cash or annuity may not be selected at the time the ticket is purchased.

Draw game prizes must be claimed within one year from the date of the drawing. Instant Game prizes must be claimed within one year of the announced End of Sales.

Playing the games

You can find your nearest traditional Delaware Lottery Retailer by visiting Where to Buy.

When you ask your Lottery Retailer for a Quick Pick ticket for any drawing game — PLAY 3, PLAY 4, Multi-Win LOTTO, POWERBALL®, MEGA MILLIONS®, LUCKY FOR LIFE™, LOTTO AMERICA® or KENO® — the Lottery terminal computer will randomly select all or some of the numbers for you. That’s the quickest and easiest way to choose numbers when you play any drawing Lottery game! The Lottery terminal has no memory of numbers selected previously. Therefore, a player could have some of the same Quick Pick numbers for different games on a ticket.

No, you do not, if you use the Quick Pick feature. Just tell your Lottery Retailer how many Quick Pick tickets you want to play and how much you want to wager for each game: PLAY 3, PLAY 4, Multi-Win LOTTO, POWERBALL®, LUCKY FOR LIFE™, LOTTO AMERICA® or KENO®. The Lottery computer will generate tickets with randomly selected numbers on them.

Delaware Laws prohibit the Lottery from selling any Lottery products via the Internet, phone or by mail. Delaware Lottery tickets are sold in a variety of Retail outlets statewide.

At this time, the Delaware Lottery does not offer this service.

Yes, the Delaware Lottery offers a Players Club. Sign up today to receive special promotions, news and notices! You can also sign up to have Winning Numbers delivered to your inbox — daily or weekly — it’s your choice.

There are NO drawings for Play 3, Play 4, or Multi-Win Lotto on Christmas Day. All other games are drawn as normally scheduled.

KENO®

You can find your nearest Delaware Lottery KENO® Retailer by visiting Where to Play.

POWERBALL®

Forty-four states, plus the District of Columbia, US Virgin Islands & Puerto Rico, participate in POWERBALL®: Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Montana, Nebraska, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Vermont, Virginia, West Virginia, Wisconsin and Wyoming.

Delaware joined with other states in the Multi-State Lottery Association (MUSL), which oversees the POWERBALL® game, so that larger jackpots and prizes can be offered to Delaware players.

An annuity refers to the payment option for POWERBALL® jackpot prize payments in which the prize money is divided up to be paid in yearly installments. POWERBALL® jackpot prizes are paid in 30 graduated payments over 29 years.

The Delaware Lottery requires all jackpot prize winners to assign a beneficiary. In the event of a winner’s death, the Lottery will continue to pay the annual payments, as scheduled, to the winner’s designated beneficiary or estate. The Lottery does not keep the money; the state does not take it. The Internal Revenue Service has special rules concerning estate taxes and expected future payments. The Lottery recommends that all jackpot winners consult a tax expert for advice.

It takes about two weeks from the time the ticket is claimed.

MEGA MILLIONS®

Forty-four states, plus the District of Columbia & US Virgin Islands, currently participate in MEGA MILLIONS®: Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, New Hampshire, New Jersey, New York, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Washington, West Virginia, Wisconsin, Wyoming, Vermont and Virginia.

Delaware joined other states in the Mega Millions Consortium , which oversees the multi-state MEGA MILLIONS® game, so that more multimillion-dollar jackpots and more prizes can be offered to Delaware Lottery players.

An annuity refers to the payment option for MEGA MILLIONS® jackpot prize payments in which the prize money is divided up to be paid in yearly installments. MEGA MILLIONS® jackpots have a guaranteed minimum estimated annuity of $40 million per drawing, plus eight set cash prizes up to $1 million. The jackpot prize will be divided equally among multiple winners. The jackpot prize for annuity option will be paid in 30 annual payments.

If a winner dies before receiving all annual payments, MEGA MILLIONS® will continue to pay the annual payments, as scheduled, to the winner’s designated beneficiary or to the winner’s estate. The Lottery does not keep the money; the state does not take it. The Internal Revenue Service has special rules concerning estate taxes and expected future payments. The Lottery recommends that all jackpot winners consult a tax expert for advice.

Winners who choose the annuity method will receive 26 annual MEGA MILLIONS® payments.

It takes about two weeks from the time the ticket is claimed.

LOTTO AMERICA®

Delaware, Idaho, Iowa, Kansas, Maine, Minnesota, Montana, New Mexico, North Dakota, Oklahoma, South Dakota, Tennessee, West Virginia

Delaware joined with other states in the Multi-State Lottery Association (MUSL), which oversees the LOTTO AMERICA® game, to offer a game that appeals to players based on its familiar play style and its ability to produce jackpots starting at $2 million.

An annuity refers to the payment option for LOTTO AMERICA® jackpot prize payments in which the prize money is divided up to be paid in yearly installments. LOTTO AMERICA® jackpots have a guaranteed minimum estimated annuity of $2 million per drawing, plus eight set cash prizes up to $100,000. The jackpot prize will be divided equally among multiple winners. The jackpot prize for annuity option will be paid in 30 annual payments.

If a winner dies before receiving all annual payments, LOTTO AMERICA® will continue to pay the annual payments, as scheduled, to the winner’s designated beneficiary or to the winner’s estate. The Lottery does not keep the money; the state does not take it. The Internal Revenue Service has special rules concerning estate taxes and expected future payments. The Lottery recommends that all jackpot winners consult a tax expert for advice.

It takes about two weeks from the time the ticket is claimed.

LUCKY FOR LIFE®

“For Life” prizes are payable for the length of a winner’s natural life. At minimum, 20 years of payments are guaranteed; however, payments could last much longer, based on the lifespan of a winner.

Arkansas, Colorado, Connecticut, Delaware, Idaho, Iowa, Kansas, Kentucky, Maine, Massachusetts, Michigan, Minnesota, Missouri, Montana, Nebraska, New Hampshire, North Carolina, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Vermont, Washington D.C. and Wyoming.

The prizes are payable as an annuity or lump sum. See complete prize chartfor details.

See explanation in the complete prize payout table.

Lump Sum Option payments will be made available for payment within 16 calendar days after the drawing date and after the claim date.

Internet Games

You must be 18 years old to play traditional Delaware Lottery games, and 21 years old to play Video Lottery, Sports Lottery and Table Games.

Winning numbers/jackpot information

You can find winning numbers in several places:

- Check out Winning Numbers on our website for the most current winning numbers. Plus, there’s an archive so you can check old tickets too!

- You can also download past winning numbersby year.

- You can sign up to receive Winning Numbers via e-mail — weekly or daily, it's your choice.

- Call the Player Information Line at 1-800-338-6200.

- You can also verify numbers at Lottery terminals, and many Retailers post winning numbers in their stores.

- Download the Delaware Lottery Smartphone App at m.delottery.com.

Winning numbers and current jackpots for POWERBALL®, MEGA MILLIONS®, and LOTTO AMERICA®, and LUCKY FOR LIFE™ are published on delottery.com, typically within one hour of each game’s respective drawing time.

Winning numbers and current jackpots for MULTI-WIN LOTTO, and winning numbers for KENO®, PLAY 3 and PLAY 4 are published on delottery.com, typically within 30 minutes of each game’s respective drawing time. In addition, the number of winners are published on the site based on the same schedule for MULTI-WIN LOTTO and PLAY 3 and PLAY 4.

(MULTI-WIN LOTTO drawings are held Monday, Wednesday and Friday at 7:57 p.m., POWERBALL® drawings are held Wednesdays and Saturdays at 10:59 p.m., MEGA MILLIONS® drawings are held Tuesdays and Fridays at 11:00 p.m., LOTTO AMERICA® drawings are held Wednesdays and Saturdays. Play until 9:45 p.m., PLAY 3 and PLAY 4 Night drawings are held every day at 7:57 p.m., and PLAY 3 and PLAY 4 Day drawings are held Monday–Saturday at 1:58 p.m., LUCKY FOR LIFE™ drawings are held Mondays and Thursdays at 10:38 p.m., and KENO® drawings are held daily every four minutes from 6:04 a.m. to 1:04 a.m.)

You can also sign up to receive winning numbers via e-mail, either daily or weekly. Daily winning numbers are typically delivered to your in-box around 9:15 p.m.; weekly winning numbers results are sent on Sundays and are typically delivered to your in-box around 9:15 p.m.

General information

You must be 18 years old to play traditional Delaware Lottery games, and 21 years old to play Video Lottery, Sports Lottery, and Table Games.

The Delaware Lottery Office is located in Suite 102, 1575 McKee Road, in the McKee Business Park in Dover. For driving information, we have Directionsfor you.

Delaware Lottery drawings (Multi-Win LOTTO and PLAY 3/PLAY 4) are posted on our website daily (Only the current drawing for that day are posted, so be sure to check each day!) And, any Delaware citizen who wishes to observe the Lottery drawing procedure may write, e-mail or call the Delaware Lottery Office in Dover and request to view a drawing.

You can check out Where the Money Goes for details on Lottery fund distribution. Briefly, most of the money is allocated to prizes (50% or more), to the General Fund (30% or more) and to Retailer commissions and bonuses (approximately 10%). Less than 5% of the proceeds is used to pay for administrative and promotional expenses.

No tax dollars are used to fund the Delaware Lottery. The Lottery is totally self-sufficient. It was established in 1974 by legislative decree. For more detailed information, visit Rules, Regulations and Financials, which includes a copy of our latest Annual Report.

Retailing

You can learn more about the opportunity to join the network of Delaware Lottery Retailers and how to apply for membership in our Retailer’s Corner.

DOVER, Del.- Delaware casinos could soon get a break. Delaware officials are considering cutting taxes on the state's three casinos, allowing them to keep more of their profits.

This comes as casinos said they are struggling to survive.

Revenue from slot machines in Delaware has fallen by 13 percent compared to last year. Casinos hope that number will convince state officials to cut them some slack.

Gambling has been legal in Pennsylvania since 2004 and casinos in the state have table games.

Maryland also opened casinos last year, drawing gamblers away from Delaware's three casinos.

Because of the increased competition, Dover Downs Hotel and Casino made no profit in the first part of 2011.

According to Dover Downs Hotel and Casino CEO Ed Sutor, 'This is the first time in Dover Downs history we have lost money. And in our second quarter we reported to the Securities and Exchange Commission that we made less than 1 percent.'

Delaware Casino Buffalo

The state's gamble on table games has also yet to pay off. Sutor said so far casinos have made no profit from their craps, poker and blackjack tables. He said a tax break would allow his casino to spend more money on marketing to help drive gamblers to the casino floor.

Delaware Casino Park Hotels

'We have no dollars to promote. We have no dollars to advertise,' he said.

Sutor said staff has been trimmed through attrition and the employee pension system has been frozen in an effort to save money and jobs. But, a tax break might save jobs for one of Kent County's largest employers.

'We are the largest private employer, we have over 1,400 employees,' Sutor said. 'But, we are also, by far, the biggest taxpayer in the county.'

Delaware Casino Anadarko

The Delaware General Assembly must pass any tax cuts for casinos. Lawmakers go back into session in January.