Spain Gambling Tax

Pressure from the European Union caused Andorra to implement its first ever income tax in 2015, but Andorra still remains a low tax haven conveniently nestled between high-tax Spain and France. Long known as a destination for duty-free shopping, Andorra is an idyllic mountainous country that also happens to offer residence permits to investors.

The Spanish parliament has voted through its 2018 fiscal budget with a number of online gambling services given a 5% tax break.

Tax on some gambling sectors will be reduced from 25% to 20%. © Pexels.

- Looking at countries around the world, the majority don’t tax gambling winnings. There are some notable exceptions, though. Winners in France pay 12% tax on any win over 1,500 Euros.

- Spanish Gaming Tax: A comparison. To put the Spanish Gaming Act and Spanish online gaming taxes into comparison, here is a brief overview of the United Kingdom’s regulations and taxes. After the UK government enacted the Betting and Gambling Act of 1960, land-based gambling venues became popular throughout Britain.

Tax taken from gambling revenues in Spain are set to be cut from 25% to 20% for some sectors with the implementation of the 2018 fiscal budget. Sports betting, exchange betting, online casinos and horse racing are set to benefit from the tax cut.

Spain has seen political change recently, with former prime minister, Marian Rajoy, ousted from his post before stepping down as leader of the conservative People’s Party in June.

However, the fiscal budget has continued through parliament under new leader Pedro Sanchez of the PSOE Socialist party after initial terms were agreed in May.

The gambling market in Spain is growing rapidly and with an expansion to its licensing program soon to be implemented, new operators will shortly be joining the Spanish market.

The market is regulated by the Dirección General de Ordenación del Juego (DGOJ) and is one of the fastest growing in Europe.

Italy bans gambling advertisements

Things aren’t looking so rosy for operators in Italy however. The country was one of Europe’s fastest growing markets, but political upheaval there looks to be sending things in the other direction.

The new coalition government in Italy has this week introduced a blanket ban of advertisements for gambling products.

All forms of adverts across all forms of media – including the internet – are set to be banned once the rule is implemented in 2019.

Those operators with advertising contracts still in place will be able to see the contracts out until the licence expires, but will be unable to renew. The cut off date will be June 2019.

Gambling Tax Rates

Not all are convinced that the move is the right one. Logico, the country’s gambling trade association, have argued that the law will force bettors to use unlicensed, illegal operators who will still be able to advertise via third-party affiliates. The unregulated nature of these operators would offer no protections for Italian consumers.

In a statement, Logico said:

Whilst fully sharing the concerns of the institutions with regard to problem gambling, LOGiCO does not believe that this ban can produce positive effects in terms of player protection or reduce – and certainly not eliminate – the risks derived from an uncontrolled practice of the games themselves.– Statement, Logico

The government obviously disputes this, but many groups, not just gambling operators, will be affected by the advertising ban. For example, over half of the teams in the country’s top football league, Serie A, are sponsored by gambling firms.

The rise of online betting in Spain has caused significant changes in Spanish gambling law. However it’s good news for players who can legally use a range of different online betting sites legally.

Check out the best online bookmakers accepting Spanish players and all the key info laws and legislation’s concerning the country below.

Best Legal & Licenced Spanish Betting Sites:

The following is a list of the best betting sites for residents of Spain:

Federal Gambling Tax Laws

Key Facts: Online Gambling In Spain

- Both online and offline gambling fully legal and regulated.

- Spanish Gambling Act passed in 2011 to deal with gambling law and licensing.

- Online gambling legal with licenced operators only.

- Unlicensed betting and gambling sites are usually blocked by internet service providers.

- Must be 18+ to gamble legally.

Gambling Legislation & Law Timeline

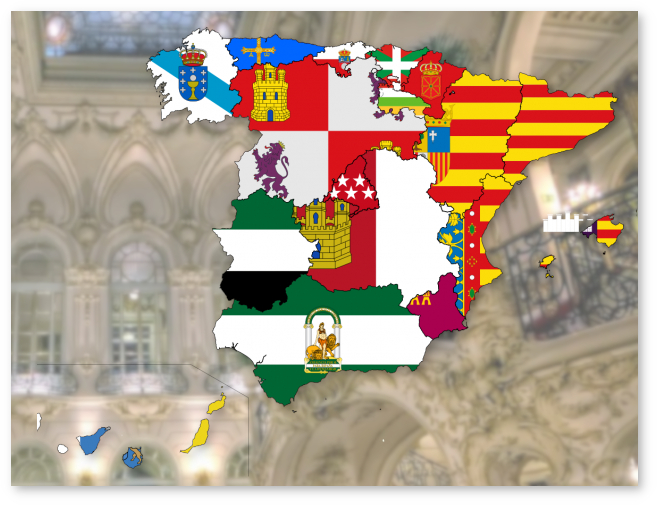

As mentioned above, the regulation and management of gambling in Spain is largely shared between the national and regional levels of government. For a long time, it was only the country’s separate regions which passed gambling legislation. The following, however, are the major milestones on the road toward the current national Spanish gambling legislative situation:

1977 – First National Legalisation

It was in 1977 that the first few forms of gambling were nationally legalised in earnest in Spain. These forms were so-called ‘skill based gambling activities’.

1981 – Further Legalisation

Just four years later, the Spanish national government extended the breadth of gambling activities considered legal in the country. The passage of legislation in 1981 led to so-called ‘games of chance’ being legalised alongside ‘skill based gambling’.

2011 – The Spanish Gambling Act

Passed essentially in response to the rapidly growing influence of online gambling, the Spanish Gambling Act of 2011 is the single most important piece of legislation when it comes to the regulation of gambling in Spain.

The act laid down the entire legal and regulatory framework of the gambling industry, defined punishments for illegal gambling, stipulated tax rates and created a national regulatory body. That regulatory body is known as the Direccion General de Ordenacion del Juego (General Directorate for the Regulation of Gambling Activities or DGOJ). It is this body which is responsible for blocking access to and for fining unlicensed online gambling sites, amongst many other powers.

Are Players Taxed On Winnings?

All of the above, therefore, should give an accurate overview of the legal situation regarding gambling in Spain. One area which we shouldn’t neglect, however, is that of taxation and particularly of if and how winnings are taxed.

Unfortunately under Spanish law, unlike the law of many other countries, not all gambling winnings are tax exempt. Only winnings under €2,500, in fact, are exempt and any winnings beyond that mark are subject to a 20% tax rate. A law passed in 2012, however, does allow punters to discount their gambling losses from tax paid on any gambling winnings accrued in the same tax year.

Recommended Deposit Methods

There are few reasons for Spanish punters to consider issues of legality when it comes to their choice of deposit method when gambling online. Even if they bet with unlicensed overseas providers, after all, punters themselves are not doing anything illegal.

Spain Gambling Tax Forms

In general, then, most Spanish punters tend to choose to deposit via debit or credit card due to the speed and ease of that particular method. Some less scrupulous punters, however, who may wish to circumvent tax do choose to deposit via E-wallet services which make the ultimate destination of their money less easy to discern and more secure.